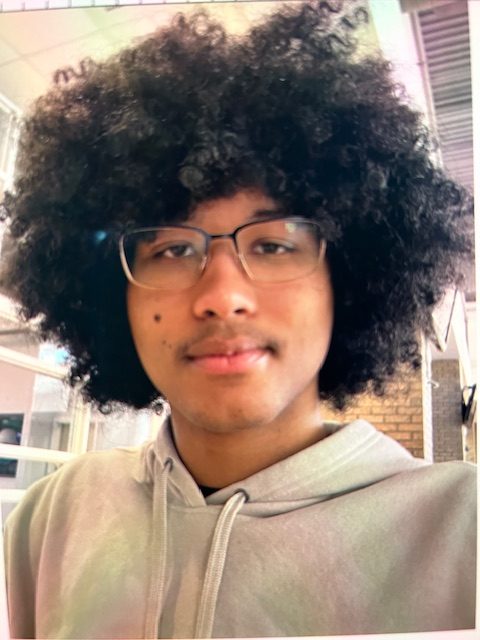

My grandson, Ben, started college a few weeks ago, attending Kent State University in Kent, Ohio. Ben spent his elementary school years being homeschooled and then transitioned to public school for middle and high school.

That transition was relatively easy for him, he quickly made friends and joined a number of clubs and activities. But going to college is different. This is not completing the school day and then going home, Kent State was going to be his new “home” for the next four years. He told me he was “scared but excited.”

But Ben did a few things to make this transition a bit easier.

- He made sure he saw his high school friends and extended family before he left. His friends were an important part of his life during the school years they shared, so seeing them and saying a temporary goodbye to them made him feel that they were not gone to him forever but would maintain some level of contact either on school breaks or social media.

- He made contact with his new roommate. This is the person he was going to be sharing a living space with so being acquainted was key. They got to share their likes and dislikes, personal preferences and routines so when they are living together there won’t be many surprises.

- He got a good understanding of the location of the buildings and areas where his classes were going to be held by studying campus maps. There’s nothing more frightening than being lost on the first day of an important event. He was able to map out the quickest routes to get from point A to point B.

- He saved money from the part time job he had during his junior and senior years and opened a checking account at a local bank. While he is on a generous meal plan, having backup money for unexpected expenses is a good idea.

- Probably the most important thing that Ben did was to refuse the credit card offer that came with opening a checking account. Credit cards can be dangerous if you don’t know how to use them correctly. It’s easy to order a pizza and whip out the credit card, or buy food for your friends, but it’s not so easy when the accumulated monthly bill comes in for payment. All of a sudden, you are looking at the bill and saying, “I didn’t realize I spent that much.” And if you get caught in the “minimum payment” trap, you will be paying for more than what you bought, you will be paying interest charges that add up quickly.

I’m sure that even with all of his planning, there will be some things that surprise Ben, but I think he will be better able to handle those surprises because he took the time to learn the basics about what to do when you go off to college.