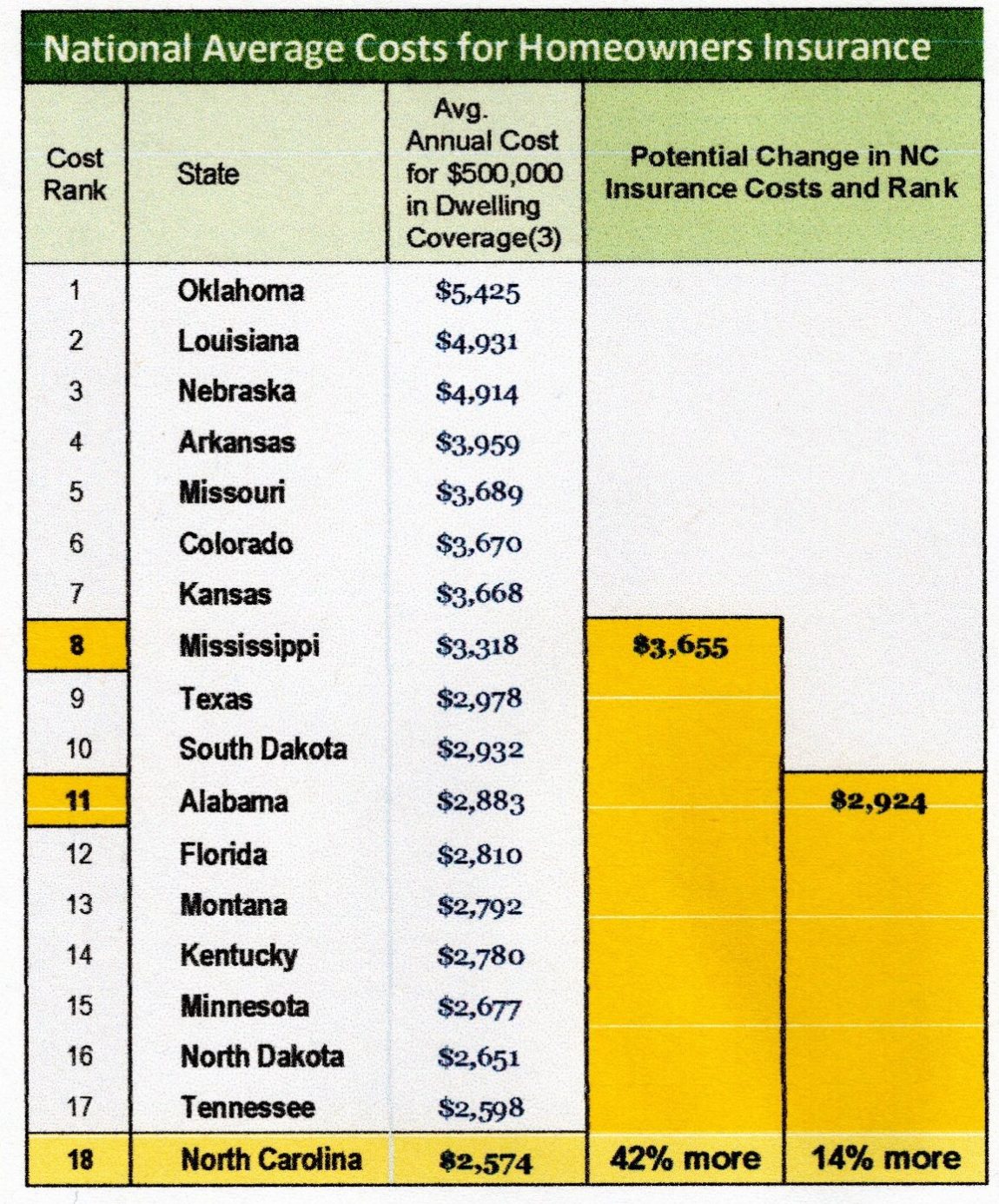

With the proposed 42% average hike in homeowners’ insurance rates for North Carolina, the state would rank #8 nationally in costs. If only one-third of the proposed increase is approved (i.e. 14% more), the state would rank #11.

Friday, February 2nd is the deadline to register an opinion about the hikes in homeowners’ insurance proposed by the North Carolina Rate Bureau (NCRB). Consumers can email the NC Department of Insurance (NCDOI) ([email protected]) which will share all comments with the bureau.

The rate bureau, which represents insurance companies, is requesting an average statewide rate increase of 42.2% for homeowners. But for many in the Cape Fear, the proposed hikes are much higher. For Brunswick, New Hanover and Pender counties they are double (99.4%) for homes in beach areas. In eastern coastal areas they top 71.4%, and are 43% for western coastal areas. Homeowners can check the proposed increase for their zip code in this table. (Rates for condos and other structures are different.)

The NCRB filed its proposal with the NCDOI January 3rd citing severe weather and higher costs. Two days later NC Insurance Commissioner Mike Causay issued a press release (1), and by January 22nd, more than 9,000 people had contacted the NCDOI. That day even more expressed opinions in the department’s live and online forums. Many homeowners are still adjusting to the last increase that took effect in 2022, and a steep increase could push some out of their homes (2), particularly those on fixed incomes.

Wastebasket

NC Representative Frank Iler (17th District) says the proposed rate tables belong in the ‘wastebasket.’ “There’s been a lot of opposition, and I’m expressing my own opposition. I live here too.

“The NCRB will not get anything near what they’re asking. The process is the insurance commissioner can deny or negotiate. If they can’t agree in 50 days, the commissioner will call for a hearing.”

If history is any guide, the 2020 proposal of a statewide average 24.5% hike was negotiated down to 7.9%. But even if the insurance companies get a third of their request, North Carolina would rise to #11 in nationwide rates for homeowners’ insurance. (See table at top of story.)

The NCDOI enlists actuaries, attorneys and consultants in determining whether the proposed increase meets technical and mathematical standards, and the Commissioner must determine by February 22nd if the proposal is “excessive, inadequate, or unfairly discriminatory.”

Proposed rates are based on many factors, but rating models can be skewed. Representative Iler recalls that when he served on the State Assembly’s Insurance Committee about 10 years ago, “The hurricane model was not effective of actual losses.” Claims in the Charlotte area totaled higher than shore areas in Brunswick and New Hanover counties, but proposed rates in the shore areas were higher.

U.S. Representative David Rauzer (7thDistrict) also urged the insurance commissioner to deny the proposal. “Such increases would negatively impact everyone who owns a home and make homeownership impossible for many.”

References

- “Commissioner Causey issues statement on recent rate filing request made by insurance companies,” NC Department of Insurance, January 5 press release. https://www.ncdoi.gov/news/press-releases/2024/01/22/commissioner-causey-issues-statement-recent-rate-filing-request-made-insurance-companies

- Julia Kauffman, “’Incredibly insulting’ | North Carolina homeowners push back on proposed insurance rate hike,” WCNC, January 22, 2024.

- Penny Gusner and Les Masterson, “The Average Home Insurance Cost For January 2024, Forbes Advisor, January 23, 2024. https://www.forbes.com/advisor/homeowners-insurance/average-cost-homeowners-insurance

Doug Ensley • Jan 31, 2024 at 11:07 am

Thank you for the timely information, Chuck!